Metoprolol tartrate vs metoprolol succinate: Understanding the differences between these beta-blockers is crucial for effective treatment. This in-depth look explores their chemical structures, pharmacokinetic profiles, clinical applications, potential side effects, and drug interactions. Navigating the nuances of each form will equip readers with a comprehensive understanding.

Both metoprolol tartrate and metoprolol succinate are commonly prescribed to manage various cardiovascular conditions. However, their distinct properties lead to variations in absorption, metabolism, and duration of action, impacting their suitability for different patients and conditions.

Introduction to Metoprolol

Metoprolol is a widely prescribed beta-blocker medication primarily used to manage high blood pressure and other cardiovascular conditions. It works by slowing down the heart rate and reducing the force of contractions, ultimately lowering blood pressure and improving overall heart health. Understanding the different forms of Metoprolol is crucial for effective patient management.The medication comes in two primary forms: Metoprolol Tartrate and Metoprolol Succinate.

Quick tip on metoprolol tartrate vs metoprolol succinate: While both are beta-blockers, understanding their different release profiles is key. This impacts how they manage blood pressure, and potentially how they affect your overall health, especially when considering factors like air pollution extreme weather copd risk. Air pollution extreme weather COPD risk can significantly worsen existing respiratory conditions, and the right medication choice can play a crucial role in managing these risks.

Ultimately, the best choice for you will depend on your individual health needs and doctor’s recommendations, but understanding the subtle differences between these medications can help you make informed decisions.

These variations differ in their chemical structure, leading to distinct release profiles and durations of action. These differences in release profiles impact how the drug is absorbed and how long its effects last, which is important for optimizing treatment and minimizing side effects.

Different Forms of Metoprolol, Metoprolol tartrate vs metoprolol succinate

Metoprolol Tartrate and Metoprolol Succinate are both beta-blockers, but they differ significantly in their pharmacokinetic properties. Metoprolol Tartrate is a rapidly absorbed form, providing a quick onset of action. Conversely, Metoprolol Succinate is a sustained-release form, offering a more prolonged and consistent therapeutic effect. This difference in release characteristics is crucial for patient management and tailored treatment regimens.

Mechanism of Action

Metoprolol primarily works by blocking beta-adrenergic receptors, specifically beta-1 adrenergic receptors. This action reduces the sympathetic nervous system’s influence on the heart. The reduced stimulation of these receptors leads to a decreased heart rate, lowered blood pressure, and a decrease in the force of heart contractions. This modulation of the sympathetic nervous system results in a calming effect on the cardiovascular system.

Comparison of Metoprolol Forms

The following table details the chemical structures of Metoprolol Tartrate and Metoprolol Succinate. While a complete chemical structure representation is beyond the scope of this blog, the table highlights the key structural differences impacting their release profiles.

| Property | Metoprolol Tartrate | Metoprolol Succinate |

|---|---|---|

| Chemical Structure | The molecule of Metoprolol Tartrate contains a chiral carbon with a specific arrangement of atoms. This arrangement is critical to its rapid absorption. | Metoprolol Succinate’s structure includes a succinate moiety attached to the core Metoprolol molecule. This modification leads to a sustained release mechanism. |

| Release Profile | Rapid-acting, offering a quick onset of action. | Sustained-release, providing a more prolonged therapeutic effect. |

| Duration of Action | Shorter duration of action compared to Metoprolol Succinate. | Longer duration of action, often allowing for once-daily dosing. |

| Dosage Frequency | Usually administered multiple times a day. | Generally administered once daily. |

Pharmacokinetics and Metabolism

Understanding the pharmacokinetic differences between Metoprolol Tartrate and Metoprolol Succinate is crucial for effective patient management. These differences significantly impact drug absorption, distribution, metabolism, and excretion, ultimately influencing the duration of action and potential side effects. This knowledge allows for tailored dosing strategies and optimized treatment outcomes.The varying pharmacokinetic profiles of Metoprolol Tartrate and Metoprolol Succinate stem from their different chemical structures.

This difference in structure leads to distinct absorption rates, metabolic pathways, and elimination half-lives. The specific characteristics of each formulation must be considered for personalized treatment plans.

Absorption Differences

Metoprolol Tartrate is rapidly absorbed, achieving peak plasma concentrations sooner than Metoprolol Succinate. This rapid absorption results in a quicker onset of action for Metoprolol Tartrate. Metoprolol Succinate, on the other hand, is absorbed more gradually, leading to a sustained release effect. This difference in absorption kinetics is directly related to the distinct chemical structures of the two formulations.

Distribution and Metabolism

Both Metoprolol Tartrate and Metoprolol Succinate are primarily metabolized in the liver. However, the specific metabolic pathways and the extent of first-pass metabolism can differ slightly. The differences in metabolism contribute to the variations in their overall pharmacokinetic profiles. Furthermore, the distribution of the drugs in the body also plays a role in their efficacy and potential side effects.

Excretion

Both forms of Metoprolol are primarily excreted in the urine, largely as metabolites. The specific metabolic pathways and subsequent excretion patterns influence the duration of action and the potential for drug accumulation.

Bioavailability

Bioavailability, the fraction of administered dose that reaches the systemic circulation, is crucial in comparing the effectiveness of the two forms. Metoprolol Succinate, often exhibits higher bioavailability compared to Metoprolol Tartrate. This translates to a larger percentage of the administered dose reaching the bloodstream and contributing to the desired therapeutic effect.

Half-Lives and Dosing Implications

The half-life of a drug is the time it takes for the concentration of the drug in the body to reduce by half. Metoprolol Tartrate has a shorter half-life, typically ranging from 3 to 6 hours. This shorter half-life necessitates more frequent dosing compared to Metoprolol Succinate. Metoprolol Succinate, with a longer half-life, typically lasting 10-24 hours, allows for less frequent dosing.

This difference in half-lives is directly correlated to the sustained-release nature of Metoprolol Succinate. Dosing frequency directly impacts patient adherence and the potential for therapeutic failure. Understanding the half-life is vital for determining the appropriate dosage regimen.

Summary Table

| Property | Metoprolol Tartrate | Metoprolol Succinate |

|---|---|---|

| Absorption | Rapid, peak plasma concentrations reached sooner | Slower, sustained release |

| Distribution | Distributed throughout the body | Distributed throughout the body |

| Metabolism | Primarily metabolized in the liver | Primarily metabolized in the liver |

| Excretion | Primarily excreted in urine as metabolites | Primarily excreted in urine as metabolites |

| Bioavailability | Generally lower | Generally higher |

| Half-life | 3-6 hours | 10-24 hours |

| Dosing | More frequent | Less frequent |

Clinical Use and Indications

Metoprolol, available in two forms—tartrate and succinate—is a widely prescribed beta-blocker used to manage various cardiovascular conditions. Understanding the differences in their pharmacokinetic profiles is crucial for selecting the appropriate formulation for a given patient. This section delves into the clinical applications of each form, highlighting their therapeutic effects and pharmacokinetic influences on treatment suitability.

Clinical Uses of Metoprolol Tartrate

Metoprolol tartrate is a rapidly acting beta-blocker, making it suitable for situations requiring immediate blood pressure reduction. Its shorter half-life necessitates more frequent dosing, which can be a factor in patient adherence. Common clinical uses include:

- Angina: Metoprolol tartrate effectively reduces the frequency and severity of angina attacks by decreasing the workload on the heart. This is achieved by lowering heart rate and blood pressure.

- Hypertension: Metoprolol tartrate is a first-line therapy for hypertension. It helps lower blood pressure by reducing cardiac output and peripheral vascular resistance.

- Post-myocardial infarction (MI): Early administration of metoprolol tartrate following a heart attack is often crucial in reducing the risk of recurrent events by lowering heart rate and preventing excessive strain on the heart.

- Migraine prophylaxis: Some studies suggest that metoprolol tartrate can be effective in preventing migraine attacks. This is believed to be due to its ability to reduce the activation of certain nerve pathways.

Clinical Uses of Metoprolol Succinate

Metoprolol succinate, a sustained-release formulation, offers a more consistent therapeutic effect throughout the day due to its longer half-life. This allows for less frequent dosing, improving patient compliance. Key clinical uses include:

- Angina: Metoprolol succinate is a good option for long-term angina management. Its sustained-release nature provides a more constant level of beta-blockade throughout the day, leading to better control of angina symptoms.

- Hypertension: Similar to metoprolol tartrate, metoprolol succinate is used for long-term hypertension management. Its sustained release action allows for effective blood pressure control over an extended period.

- Heart failure: In some cases, metoprolol succinate may be used in the management of heart failure. Its sustained release profile can provide a more consistent reduction in heart rate and blood pressure, which can be beneficial for patients with heart failure.

- Anxiety and panic disorder: Metoprolol succinate, like other beta-blockers, can help manage the physical symptoms associated with anxiety and panic attacks. This includes reducing heart rate, tremors, and sweating.

Comparison of Therapeutic Effects

Metoprolol tartrate’s rapid onset of action makes it suitable for situations needing immediate response, such as acute angina attacks. Metoprolol succinate, with its sustained release, provides a more constant level of beta-blockade throughout the day, making it ideal for long-term management of conditions like hypertension and angina.

Pharmacokinetic Influence on Suitability

The different pharmacokinetic profiles significantly impact the choice of formulation. Metoprolol tartrate’s rapid onset and shorter half-life are advantageous in acute situations, but its frequent dosing requirements can affect patient adherence. Conversely, metoprolol succinate’s sustained-release nature allows for once-daily dosing, improving patient compliance, particularly for long-term conditions.

Ever wondered about the difference between metoprolol tartrate and metoprolol succinate? While both are beta-blockers used to manage blood pressure and heart rate, their release profiles differ, impacting how long they work in your system. This subtle difference can significantly affect your daily life, especially if you’re trying to manage your health alongside other factors, such as the impact of ultraprocessed food on longevity.

Recent research highlights that a diet heavy in ultraprocessed food will increase your chance of an early death, as this article explains , so understanding how your medications work alongside your lifestyle choices is crucial. Ultimately, the best approach to choosing between metoprolol tartrate and metoprolol succinate is to discuss it with your doctor, considering your specific health needs.

Typical Dosages

| Condition | Metoprolol Tartrate (mg) | Metoprolol Succinate (mg) |

|---|---|---|

| Angina | 50-200 mg BID-TID | 25-200 mg daily |

| Hypertension | 50-200 mg BID-TID | 25-100 mg daily |

| Post-MI | 50-100 mg BID-TID (initially lower doses, titrated up) | 25-50 mg daily (initially lower doses, titrated up) |

| Heart Failure | 25-100 mg BID-TID | 25-50 mg daily |

Note: Dosages are examples and should be determined by a physician based on individual patient needs and conditions. Always consult with a healthcare professional before initiating or modifying any medication regimen.

Potential Side Effects and Contraindications: Metoprolol Tartrate Vs Metoprolol Succinate

Metoprolol, available in both tartrate and succinate forms, is a commonly prescribed beta-blocker for managing various cardiovascular conditions. Understanding the potential side effects and contraindications is crucial for safe and effective patient management. This section delves into the common and uncommon side effects, contraindications, and how pharmacokinetic differences influence the risk profile of each formulation.

Common Side Effects

Beta-blockers, like metoprolol, can cause a range of side effects, some more prevalent than others. Common side effects typically manifest early in treatment and often resolve as the body adjusts. These effects can vary in severity and duration.

- Fatigue and Weakness: Patients may experience feelings of tiredness, lethargy, and weakness. This is often mild and temporary, but should be monitored for severity and potential impact on daily activities.

- Dizziness and Lightheadedness: These symptoms are common, potentially due to the medication’s effect on blood pressure and heart rate. Patients should be cautioned about driving or operating machinery if experiencing these effects.

- Bradycardia: A slower heart rate (bradycardia) is a potential side effect. While often manageable, it can be more pronounced in individuals with pre-existing heart conditions. Regular monitoring of heart rate is essential.

- Cold Extremities: Metoprolol can affect blood flow, leading to a sensation of coldness in the hands and feet.

- Nausea and Vomiting: Some patients report gastrointestinal upset, including nausea and vomiting, although this is less common.

Uncommon Side Effects

While less frequent, some side effects associated with metoprolol can be more serious and require prompt medical attention. It’s vital to recognize these potential complications.

- Depression and Anxiety: Mood changes, such as feelings of depression or anxiety, can occur in some individuals. These changes should be monitored and addressed if they become significant or persistent.

- Sexual Dysfunction: Reduced libido and erectile dysfunction have been reported as side effects. This is an uncommon but important consideration for patients.

- Sleep Disturbances: Difficulties with sleep, including insomnia or vivid dreams, can occur in some patients.

- Skin Reactions: Rarely, skin rashes or allergic reactions can develop.

Contraindications

Specific situations may preclude the use of metoprolol, regardless of formulation.

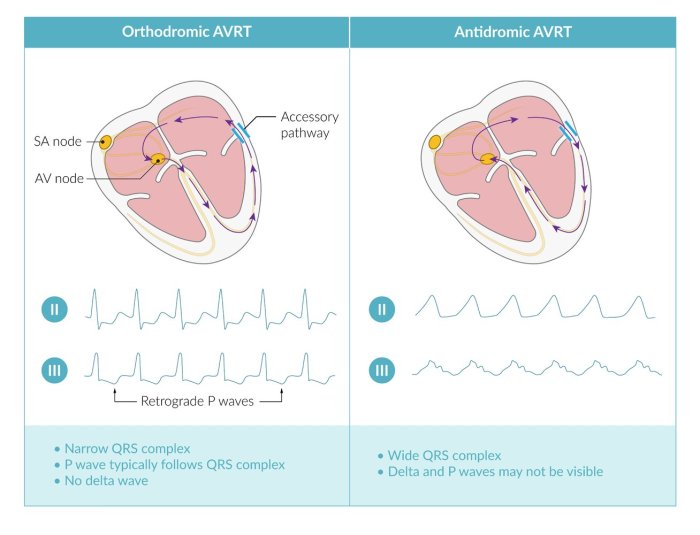

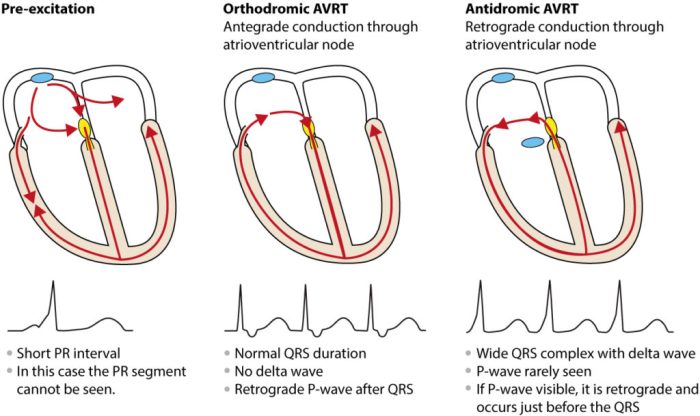

- Severe Bradycardia: Individuals with significantly slow heart rates should avoid metoprolol due to the risk of further slowing the heart rhythm.

- Severe Heart Block: Patients with severe heart block may not tolerate metoprolol’s effect on the heart’s electrical conduction system.

- Cardiogenic Shock: This serious condition, characterized by low blood pressure and inadequate organ perfusion, is a contraindication for metoprolol.

- Asthma or Bronchospasm: Metoprolol can worsen bronchospasm, so it should be avoided in individuals with these conditions.

- Severe Peripheral Vascular Disease: Individuals with severe peripheral vascular disease may not tolerate metoprolol’s potential impact on blood flow.

Impact of Pharmacokinetic Differences

The different pharmacokinetic profiles of metoprolol tartrate and succinate can influence the risk of side effects. Metoprolol succinate, with its sustained-release formulation, provides a more consistent level of drug in the bloodstream. This can reduce the risk of abrupt changes in blood pressure and heart rate, minimizing the likelihood of certain side effects like dizziness or lightheadedness.

Table of Potential Side Effects

| Side Effect | Metoprolol Tartrate (Frequency) | Metoprolol Succinate (Frequency) |

|---|---|---|

| Bradycardia | Moderate | Lower |

| Fatigue | Common | Common |

| Dizziness | Common | Less Common |

| Cold Extremities | Common | Common |

| Depression | Uncommon | Uncommon |

| Sexual Dysfunction | Uncommon | Uncommon |

Note: Frequency classifications are general guidelines and individual responses may vary. Consult with a healthcare professional for personalized advice.

Drug Interactions

Metoprolol, in its various forms (tartrate and succinate), can interact with other medications, potentially affecting its efficacy or safety. Understanding these interactions is crucial for prescribing and managing treatment effectively. Careful consideration of concurrent medications is vital to prevent adverse events and optimize patient outcomes.Interactions with metoprolol can arise from several mechanisms, including competition for metabolic pathways, alteration of drug absorption, or modification of drug elimination.

The different pharmacokinetic profiles of metoprolol tartrate and metoprolol succinate can influence the extent and nature of these interactions. Recognizing these potential complications is paramount for healthcare professionals to make informed decisions about medication regimens.

Figuring out metoprolol tartrate vs metoprolol succinate can be tricky, but the key difference lies in how long the medication stays in your system. Sometimes, you might notice bumps on the back of your tongue, which can be a symptom of various things. While those bumps could be a sign of a larger issue, understanding the different release mechanisms of metoprolol, like tartrate versus succinate, is crucial for effective blood pressure management.

Ultimately, consulting a doctor is always the best approach for any health concerns, including both medication choices and potential tongue issues like those found at bumps on back of tongue.

Potential Drug Interactions with Metoprolol

Concurrent use of metoprolol with certain medications can lead to unpredictable effects. Some medications can either enhance or diminish the effectiveness of metoprolol, potentially causing adverse reactions or requiring dosage adjustments.

Examples of Interacting Medications

A variety of medications can interact with metoprolol. These interactions can occur through several mechanisms, and the specific impact varies depending on the interacting drugs.

- Calcium Channel Blockers: Some calcium channel blockers, particularly verapamil and diltiazem, can potentially exacerbate the bradycardic (slow heart rate) effects of metoprolol. This combination may lead to significant decreases in heart rate, potentially resulting in symptomatic bradycardia, or even heart block in susceptible individuals. Dosage adjustments or careful monitoring are often necessary to manage the risks.

- Antihypertensives: Combining metoprolol with other antihypertensive medications (e.g., ACE inhibitors, diuretics) can lead to an additive hypotensive effect. This means the combined effect of the medications can lower blood pressure more than expected. Close monitoring of blood pressure and possible dosage adjustments are necessary.

- Nonsteroidal Anti-inflammatory Drugs (NSAIDs): NSAIDs can reduce the renal excretion of metoprolol, potentially leading to increased metoprolol levels in the blood. This can heighten the risk of metoprolol-related side effects. Careful consideration of NSAID use in patients taking metoprolol is essential.

- CYP2D6 Inhibitors: Certain medications inhibit the enzyme CYP2D6, which plays a role in metoprolol metabolism. This inhibition can result in higher metoprolol concentrations, increasing the risk of adverse effects. Examples of CYP2D6 inhibitors include fluoxetine, paroxetine, and quinidine.

Pharmacokinetic Differences and Interactions

The differences in pharmacokinetic profiles between metoprolol tartrate and metoprolol succinate can affect the nature of interactions. Metoprolol tartrate is a rapidly absorbed and eliminated drug, while metoprolol succinate is a sustained-release formulation, leading to a more prolonged effect. These differences in the time course of drug action can influence the severity and duration of drug interactions.

Methods to Avoid Potential Drug Interactions

Thorough medication reconciliation and communication between healthcare providers are crucial. Comprehensive medication lists should be reviewed before prescribing metoprolol to identify potential interactions. Close monitoring of patients receiving concomitant medications is essential. Dosage adjustments or alternative treatment strategies may be necessary to minimize risks. Open communication between patients and healthcare providers regarding all medications, including over-the-counter and herbal remedies, is essential to prevent unintended drug interactions.

Patient Considerations and Considerations for Switching

Choosing between metoprolol tartrate and metoprolol succinate requires careful consideration of individual patient needs. Both medications are beta-blockers used to manage hypertension and other cardiovascular conditions, but their differing release profiles impact their efficacy and tolerability. Understanding these differences is crucial for tailoring treatment to optimize outcomes and minimize potential side effects.

Important Patient Considerations for Prescribing

Patient characteristics, such as renal function, hepatic function, and overall health status, play a significant role in the selection of the appropriate metoprolol formulation. Individual patient responses to the medication also vary. Factors like age, comorbidities, and concurrent medications need to be carefully assessed to determine the best choice.

Factors Influencing the Decision to Switch

Several factors can influence the decision to switch from one metoprolol form to another. A patient’s response to the initial medication, the presence of side effects, and the need for a more convenient dosing schedule are common considerations. The patient’s adherence to the current regimen and the potential impact on their lifestyle also play a role. For example, if a patient struggles to remember to take multiple daily doses of tartrate, a once-daily succinate formulation might be preferable.

Careful Monitoring When Switching Between Forms

Switching between metoprolol tartrate and metoprolol succinate requires careful monitoring to ensure a smooth transition and prevent adverse events. Blood pressure and heart rate should be closely monitored during the transition period. Symptoms such as dizziness, lightheadedness, or fatigue should be addressed promptly. This close observation is particularly important for patients with underlying cardiovascular conditions. A gradual dose adjustment is often necessary to avoid abrupt changes in blood pressure or heart rate.

Patient Scenarios Warranting a Switch

Several patient scenarios might warrant a switch between the two forms of metoprolol. For example, a patient experiencing significant side effects, such as nausea or fatigue, from tartrate may benefit from the smoother release profile of succinate. Patients with renal or hepatic impairment may require a different dosing regimen to manage the medication’s metabolism. Furthermore, a patient struggling with adherence to a multiple-dose regimen might be better suited to a once-daily succinate formulation.

Procedure for a Safe Medication Switch

A safe medication switch between metoprolol tartrate and metoprolol succinate follows a structured procedure. This procedure involves tapering the current dose of tartrate while gradually increasing the dose of succinate. The transition should be gradual, over several days, to minimize the risk of hypotension or bradycardia. Monitoring vital signs and assessing patient tolerance are crucial throughout the switch.

The physician should provide detailed instructions to the patient regarding the dosage adjustment and monitoring schedule. For example, the physician may instruct the patient to monitor their blood pressure at home and report any significant changes to the clinic.

Final Review

In conclusion, choosing between metoprolol tartrate and metoprolol succinate involves careful consideration of individual patient needs and characteristics. Understanding the pharmacokinetic differences, potential side effects, and drug interactions is paramount to ensuring optimal treatment outcomes. This comprehensive analysis provides a valuable resource for healthcare professionals and patients alike.

![[100+] Gray Gradient Backgrounds | Wallpapers.com What is gray matter in the brain](https://lyricapills.com/wp-content/uploads/2025/06/wp2249260-1.jpg)