Why not wait until im sick to buy health insurance – Why not wait until I’m sick to buy health insurance? This question often pops up, but delaying coverage until you’re unwell is a risky financial and health move. Unexpected illnesses can quickly deplete savings, leading to significant debt. Preventive care, often covered by insurance, is crucial for maintaining good health and avoiding costly treatments down the line.

Understanding the financial implications and the importance of preventative care is key to making smart healthcare decisions.

This post explores the financial and personal consequences of delaying health insurance, highlighting the importance of proactive planning. It will delve into the role of preventative care, insurance as a risk management tool, and how proactive healthcare choices can affect your overall quality of life.

Understanding the Financial Implications: Why Not Wait Until Im Sick To Buy Health Insurance

Delaying health insurance until you’re sick can lead to devastating financial consequences. The cost of medical care can quickly spiral out of control, potentially bankrupting individuals and families. This isn’t just a theoretical concern; it’s a very real and tangible threat. Understanding the financial implications is crucial for making informed decisions about your health and well-being.The financial burden of unexpected illnesses or injuries without health insurance can be catastrophic.

Don’t put off buying health insurance until you’re sick! Waiting until you need major medical care is often a costly mistake. Think about how many steps it takes to walk a mile; how many steps in one mile varies depending on your stride, but it’s definitely a significant number. Similarly, waiting until you need significant medical care will likely cost you a lot more in the long run.

It’s much better to be proactive and get coverage now.

A seemingly minor illness can quickly escalate into significant medical expenses, and the cost of treatment for serious conditions can be astronomical. Preventative care, on the other hand, is often far less expensive than treating a condition that has progressed to a severe stage. The proactive approach to health is often more cost-effective in the long run.

Financial Consequences of Delayed Insurance

Unforeseen medical emergencies can quickly deplete savings and lead to significant debt. Consider a scenario where a routine checkup turns into a serious diagnosis requiring extensive treatment. Without insurance, the associated costs can easily exceed available funds. This can have a ripple effect on other financial obligations and significantly impact overall financial stability. Medical debt can negatively affect credit scores, making it harder to secure loans or mortgages in the future.

Comparison of Preventative Care and Treatment Costs

Preventative care, such as regular checkups, vaccinations, and healthy lifestyle choices, significantly reduces the risk of developing serious illnesses. The costs associated with these preventative measures are often minimal compared to the exorbitant expenses of treating advanced diseases. For example, a yearly physical and blood tests, while costing a few hundred dollars, can identify potential health problems early, potentially preventing thousands or even hundreds of thousands of dollars in future medical expenses.

Scenario-Based Cost Comparison

The following table illustrates the potential difference in costs between having health insurance and not having it, based on various scenarios. It’s crucial to remember that these are estimates and actual costs can vary greatly depending on the specific circumstances.

| Scenario | Estimated Medical Expenses (without insurance) | Estimated Monthly Health Insurance Premium |

|---|---|---|

| Minor Illness (e.g., flu) | $500 – $1,000 | $50 – $150 |

| Major Illness (e.g., heart attack) | $50,000 – $100,000+ | $500 – $1,000+ |

| Surgery (e.g., knee replacement) | $20,000 – $40,000+ | $500 – $1,000+ |

| Chronic Condition Management (e.g., diabetes) | $10,000 – $20,000+ per year | $500 – $1,000+ |

This table demonstrates that even minor illnesses can quickly become significant financial burdens without health insurance. The cost of preventative care pales in comparison to the potential costs of treating a serious condition or undergoing major surgery. The table emphasizes the significant financial advantage of having health insurance, which can often absorb the majority of these costs.

The Importance of Preventative Care

Staying healthy isn’t just about reacting to illness; it’s about proactively taking steps to maintain well-being. Preventative care plays a crucial role in this process, allowing individuals to address potential health issues before they escalate into serious problems. By prioritizing regular check-ups and screenings, individuals can significantly improve their long-term health and potentially save money in the long run.Preventative care is a cornerstone of a healthy lifestyle, focusing on early detection and intervention.

Regular check-ups and screenings, often covered by insurance, can identify conditions in their early stages, when treatment is more effective and less costly. This proactive approach not only improves individual health outcomes but also reduces the financial burden of prolonged or complex illnesses.

Preventative Care and Early Detection

Early detection of potential health issues is vital for effective treatment. Regular check-ups and screenings allow healthcare providers to identify problems before they cause noticeable symptoms. For example, routine mammograms can detect breast cancer in its early stages, when treatment is more likely to be successful and less invasive. Similarly, colonoscopies can identify polyps or precancerous growths in the colon, allowing for removal before they develop into cancer.

Putting off health insurance until you’re sick is a risky move. Think about it – dealing with a serious health issue like diastolic dysfunction and diastolic heart failure p2, found here , can be incredibly expensive without coverage. Proactive health insurance protects you from those hefty bills and helps you focus on getting better, not on how to pay for treatment.

It’s far smarter to be prepared and get coverage now.

This early intervention often leads to better outcomes and a lower risk of long-term complications.

Preventative Measures Covered by Insurance

Insurance companies often cover a range of preventative care services, recognizing their significant impact on overall health and cost savings. These services are designed to detect potential health problems early, when they are most easily addressed.

- Vaccinations: Immunizations against various diseases, such as influenza, pneumonia, and certain cancers, are often covered in full. These vaccinations protect individuals from potentially debilitating illnesses, reducing the need for costly treatments or hospitalizations. For example, the HPV vaccine can help prevent cervical cancer, saving individuals from significant financial and health burdens in the future.

- Routine Check-ups: Annual physical exams, including blood pressure and cholesterol checks, are typically covered by most insurance plans. These check-ups help maintain a baseline understanding of overall health and identify potential problems early. A yearly checkup with your doctor, including a comprehensive review of your medical history and risk factors, can detect emerging problems before they escalate.

- Screenings: Screenings for various conditions, such as mammograms for breast cancer, colonoscopies for colon cancer, and Pap smears for cervical cancer, are often covered, particularly when performed according to recommended guidelines. These screenings can help identify problems in their early stages, often leading to more effective and less invasive treatments.

Preventative Measures Not Covered by Insurance

While many preventative measures are covered by insurance, some are not. It’s essential to understand what is and isn’t covered to manage healthcare costs effectively. The cost of these measures may vary, depending on the individual’s health status, and specific circumstances.

- Certain Wellness Programs: Some wellness programs, such as those focused on nutrition and exercise, may not be fully covered by insurance. However, many plans offer incentives or encourage these healthy behaviors through discounts or reimbursements for fitness programs. While not always fully covered, programs focusing on weight management or improved dietary habits might offer benefits through discounts on nutritional consultations or health and fitness programs.

- Specific Diagnostic Tests: Diagnostic tests that are not considered routine preventative screenings, or those not recommended by medical guidelines, may not be fully covered by insurance. These tests are typically performed only when a potential problem is suspected or when there is a known risk factor, such as a family history of a specific condition.

- Alternative Therapies: Alternative therapies, such as acupuncture or massage therapy, may not be covered by insurance. Many insurance companies are gradually expanding coverage to incorporate these practices as the evidence for their benefits grows. Individual insurance plans vary greatly in their coverage for alternative therapies.

Health Insurance as a Financial Tool

Protecting your financial well-being is crucial, and health insurance plays a significant role in achieving this goal. It’s not just about covering medical bills; it’s a strategic financial tool that mitigates risk and promotes long-term financial security. Understanding how health insurance functions as a risk management instrument empowers you to make informed decisions about your health and finances.Health insurance acts as a critical risk management tool by transferring the financial burden of unforeseen health events to a larger group.

This collective approach, known as risk pooling, benefits everyone involved. Instead of individuals facing the full brunt of potentially catastrophic medical expenses, the premiums paid by everyone in the pool contribute to a fund that helps cover these costs.

Risk Pooling and Its Benefits

Risk pooling is a fundamental concept in health insurance. It essentially means that a large group of people share the financial risk of unexpected illnesses or injuries. When one person experiences a significant medical event, the pooled funds from the premiums paid by other members help cover the associated costs. This collective approach reduces the financial strain on any single individual, making it a vital tool for financial protection.

How Premiums Cover Potential Future Expenses

Premiums are the periodic payments individuals make to maintain their health insurance coverage. These payments are essentially contributions to the risk pool. The amount of each premium is determined by several factors, including the type of coverage, the individual’s health status, and the claims history of the insurance provider. Premiums help build a financial cushion to address future health expenses, preventing financial ruin during a medical crisis.

For instance, a healthy individual contributing to a risk pool will benefit when a less healthy member needs extensive care. This system, while complex, is essential for maintaining affordability and accessibility for everyone.

Affordable Care and the Benefits of Consistent Coverage

Consistent health insurance coverage is paramount to ensuring financial stability. Without it, individuals face a high risk of being burdened by medical expenses, which can quickly deplete savings and cause significant financial hardship. Affordable care, made possible by well-structured risk pooling, provides a crucial safety net. This predictable and affordable expense, compared to the potential cost of an unexpected illness or injury, is an essential financial tool for maintaining peace of mind.

By having consistent coverage, individuals can focus on their well-being and pursue their life goals without the constant worry of escalating medical costs.

The Impact on Quality of Life

Waiting until you’re sick to buy health insurance can significantly impact your overall quality of life. It’s more than just a financial burden; it creates a constant source of stress and anxiety, potentially affecting your ability to fully enjoy life’s experiences. Choosing proactive health protection, through insurance, offers peace of mind and a more positive outlook on the future.Procrastinating on health insurance can lead to a cascade of negative consequences that extend far beyond just medical bills.

The worry and stress associated with potential future medical expenses can seep into every aspect of your life, making it harder to focus on work, family, and personal well-being. This constant pressure can create a cycle of negativity, impacting your mental and emotional health.

Negative Effects on Work Performance

Unexpected medical expenses can disrupt work schedules, requiring time off for appointments or recovery. The stress of these uncertainties can lead to decreased productivity, missed deadlines, and even job loss in severe cases. A secure health insurance plan allows for peace of mind, reducing work-related anxieties and enabling employees to focus on their jobs without constant worry.

Impact on Family Responsibilities

Family life can be severely impacted by unexpected illnesses or injuries. The financial strain of medical bills can create tension and stress within the family unit. A well-structured health insurance plan can provide a safety net, enabling families to cope with medical emergencies without facing significant financial hardship. This financial security allows families to focus on each other’s well-being and support, fostering a stronger and more harmonious family environment.

Impact on Personal Well-being

The constant fear of unexpected medical bills can significantly impact personal well-being. It can lead to increased stress, anxiety, and depression. This constant worry can interfere with daily activities, hobbies, and relationships. Investing in a health insurance plan can reduce this burden, promoting a sense of security and enabling individuals to pursue their personal goals and interests without the constant shadow of financial worry.

Comparison of Stress and Anxiety

The stress and anxiety associated with facing unexpected medical bills are substantial and often debilitating. Imagine the worry of not knowing how you will afford treatment, the sleepless nights spent calculating costs, and the fear of potential financial ruin. Health insurance, on the other hand, provides a sense of peace of mind. Knowing that you have a safety net to fall back on reduces stress and anxiety, allowing you to focus on your health and well-being.

This peace of mind is invaluable and should not be underestimated.

Potential Impacts Across Life Stages, Why not wait until im sick to buy health insurance

| Life Stage | Potential Impact of Delayed Insurance | Impact of Health Insurance |

|---|---|---|

| Young Adults | Limited access to preventative care, difficulty affording necessary treatment, potential for long-term health issues if not addressed early. | Access to preventative care, early diagnosis and treatment of conditions, reducing the risk of long-term health problems. |

| Parents | Financial strain on family resources, potential for missed work or childcare, stress related to potential health issues of children or spouse. | Financial security for family health needs, peace of mind for the family, reduced stress related to unexpected illnesses or injuries. |

| Seniors | Difficulty affording necessary care, potential for loss of independence, financial strain on retirement funds. | Access to necessary healthcare, maintenance of independence, peace of mind for financial security in retirement. |

Alternatives and Strategies

Navigating the healthcare landscape can feel daunting, especially when faced with financial constraints. This section explores practical strategies for managing healthcare costs, empowering you to take control of your well-being without breaking the bank. Understanding your options and proactively planning can significantly reduce stress and anxiety related to healthcare expenses.Effective management of healthcare costs is not just about finding the cheapest plan; it’s about finding the right plan for your specific needs and financial situation.

It’s about understanding the trade-offs between cost and coverage and making informed decisions based on your individual circumstances.

Managing Healthcare Costs

Careful budgeting and cost-saving strategies are essential for navigating healthcare expenses. A proactive approach can significantly reduce financial strain.

- Negotiate Prices: Many healthcare providers allow for negotiation on the price of services. This is particularly true for procedures like dental work, vision care, and even some medical tests. Be prepared to advocate for yourself and present your needs and concerns. Don’t hesitate to ask for different payment options, discounts, or financial assistance programs.

- Utilize Health Savings Accounts (HSAs): HSAs are tax-advantaged accounts that allow individuals to set aside pre-tax dollars specifically for healthcare expenses. Contributions to an HSA can reduce your taxable income, and the funds can be used to pay for eligible medical expenses without being taxed. This is a powerful tool for saving and managing healthcare costs effectively.

- Explore Flexible Spending Accounts (FSAs): Similar to HSAs, FSAs allow you to set aside pre-tax dollars for eligible medical expenses. However, the funds in an FSA are typically used for expenses not covered by insurance. FSAs may be more suitable for individuals who have a predictable pattern of healthcare expenses or who have a high deductible health plan.

Resources for Financial Barriers

Numerous resources are available to assist individuals facing financial barriers to accessing health insurance or healthcare services.

- Government Programs: The government offers various programs to help low-income individuals and families afford health insurance, including Medicaid and the Affordable Care Act marketplace. These programs provide subsidies to lower the cost of insurance premiums and help reduce out-of-pocket expenses.

- Nonprofit Organizations: Numerous nonprofits offer financial assistance for healthcare services. These organizations often provide grants, subsidies, or other forms of financial support to those who meet specific eligibility criteria. Look for local organizations in your community or search online for national resources.

- Community Health Centers: Community health centers offer affordable healthcare services to underserved populations. They often provide a wide range of primary care services, dental care, and other medical needs at lower costs than traditional healthcare providers.

Lower-Cost Plans and Subsidies

Discovering lower-cost plans or available subsidies is a critical step in managing healthcare costs.

- Explore the Health Insurance Marketplace: The Health Insurance Marketplace (healthcare.gov) offers a variety of plans from different insurance providers. You can compare plans based on your location, needs, and budget, and see if any subsidies are available to help lower your premiums. Comparing plans is an essential step for individuals looking to minimize costs and maximize coverage.

- Consider High-Deductible Health Plans (HDHPs) with Health Savings Accounts (HSAs): HDHPs typically have lower premiums but higher deductibles. Pairing an HDHP with an HSA allows you to save pre-tax dollars toward future healthcare expenses, offsetting the higher deductible. This can be a cost-effective approach for individuals who anticipate needing healthcare services and have a high degree of financial discipline.

Budgeting and Savings Plans

Creating a structured budget and establishing a savings plan for healthcare expenses are essential strategies.

- Detailed Budgeting: Tracking all healthcare-related expenses, including insurance premiums, deductibles, co-pays, and out-of-pocket costs, is crucial. This allows you to understand where your money is going and identify areas for potential savings.

- Savings Allocation: Allocate a specific portion of your budget for healthcare expenses each month. Regular savings, even small amounts, can significantly impact your ability to manage unexpected medical costs.

Addressing Misconceptions

Many people delay purchasing health insurance, believing it’s unnecessary or too expensive until they get sick. However, this approach often leads to significant financial and health burdens. Understanding the common misconceptions surrounding health insurance is crucial for making informed decisions about your well-being.Misconceptions about health insurance can lead to poor financial planning and potentially compromise one’s health. By dispelling these myths, we can encourage proactive and responsible healthcare choices.

Common Misconceptions About Health Insurance

Delaying health insurance purchases until you are sick is a prevalent misconception, often fueled by a belief that insurance is only necessary for serious illnesses. This perspective overlooks the critical role of preventative care and the financial implications of unexpected health events.

Waiting until you’re sick to buy health insurance is a risky move. Imagine needing immediate care for a stress fracture – a tiny crack in a bone, often caused by overuse – or any other serious ailment. What is a stress fracture can be a real pain, and you’ll be scrambling to find coverage, potentially facing hefty bills.

It’s far better to have health insurance in place, proactively, so you’re covered when you need it, rather than waiting for a crisis.

Financial Implications of Waiting

Waiting until you are seriously ill to purchase health insurance can lead to substantial financial strain. Medical bills for serious conditions can easily exceed the capacity of most individuals’ savings or income. Even seemingly minor illnesses can quickly spiral into substantial costs, further exacerbating financial difficulties.

Health Consequences of Waiting

Waiting until you are sick to purchase health insurance can significantly impact your health. Untreated conditions often worsen over time, leading to more severe and expensive medical interventions. Proactive preventative care, such as regular check-ups and screenings, is often much more effective and less expensive than addressing a problem after it has become a significant issue. This proactive approach can significantly reduce the risk of future health complications.

Misconception vs. Reality

| Common Misconception | Correct Interpretation |

|---|---|

| Health insurance is only needed if I get seriously ill. | Health insurance provides comprehensive coverage for a wide range of medical needs, including preventive care, routine check-ups, and treatment for various illnesses, not just serious conditions. |

| Health insurance is too expensive. | While premiums can vary, many options are available to fit different budgets. Exploring different plans and considering cost-saving strategies can help make health insurance more affordable. Furthermore, the potential financial burden of an unexpected illness or injury far outweighs the cost of preventative care. |

| I can easily afford medical care out-of-pocket. | Unforeseen medical expenses can quickly deplete savings and significantly impact financial stability. The cost of treatment for chronic conditions or unexpected injuries can easily exceed what most individuals can afford without insurance. |

Long-Term Financial Planning

Putting off health insurance might seem like a short-term financial win, but it can have devastating long-term consequences. Ignoring preventative care and waiting until illness strikes can lead to exorbitant medical bills that quickly deplete savings and jeopardize future financial security. Understanding the potential financial burden of unexpected health crises is crucial for long-term planning.Failing to proactively plan for future healthcare costs can significantly impact your financial stability.

The escalating costs of medical treatments, procedures, and long-term care can quickly drain savings, forcing you to rely on debt or jeopardize other financial goals. This often results in a significant loss of control over your financial future.

Long-Term Implications of Delayed Insurance

Delayed health insurance can result in a cascade of financial problems. Unexpected illnesses or injuries can lead to substantial out-of-pocket expenses that are difficult to manage without adequate coverage. This can include emergency room visits, hospital stays, surgeries, and ongoing treatments. These expenses can quickly deplete savings and create a cycle of debt, impacting other aspects of your life, like retirement planning and education funds.

Planning for Future Health Expenses

Proactive planning for future health expenses is essential for maintaining financial stability. It involves understanding potential healthcare costs and developing strategies to mitigate those risks. This requires careful budgeting, setting aside funds for unexpected events, and exploring available resources to manage costs.

Examples of Protecting Assets and Securing Financial Stability

One effective strategy is establishing a dedicated health savings account (HSA). HSAs allow pre-tax contributions that can be used for qualified medical expenses, effectively reducing your tax burden and building a safety net. Furthermore, considering long-term care insurance can provide crucial protection against the escalating costs of care as you age. These strategies can protect assets and build a financial cushion for unforeseen health events.

Financial Planning Guide

- Assess Current Health Status and Potential Risks: Evaluate your current health condition and any potential health risks. This includes family history, lifestyle factors, and any pre-existing conditions. Understanding your individual risk profile is crucial for developing a personalized plan.

- Estimate Future Healthcare Costs: Research average costs for common medical procedures, treatments, and long-term care. Use online resources and consult with healthcare professionals to obtain accurate estimates. This is a crucial step to estimate the amount needed for financial preparedness.

- Develop a Budget and Set Aside Funds: Allocate a specific portion of your budget for healthcare expenses. Create a savings plan to regularly contribute to a dedicated health account, like an HSA. This regular savings builds a buffer against unexpected medical costs.

- Explore Insurance Options: Research different health insurance plans and evaluate coverage options. Consider factors like premiums, deductibles, and co-pays to choose the best plan that aligns with your budget and needs. Review different plans and compare coverage.

- Review and Adjust Your Plan Regularly: Your financial situation and health needs can change over time. Review your plan at least annually to ensure it remains effective. Regular reviews allow you to adjust your plan to address evolving needs and maintain financial stability.

End of Discussion

In conclusion, waiting until you’re sick to buy health insurance is not a financially or health-wise sound strategy. Prioritizing preventative care and consistent coverage through insurance is a far better approach. Understanding the financial implications, the importance of preventative care, and the benefits of consistent insurance coverage empowers you to make informed decisions about your health and well-being.

Proper planning for future healthcare expenses is crucial for protecting your assets and securing financial stability.

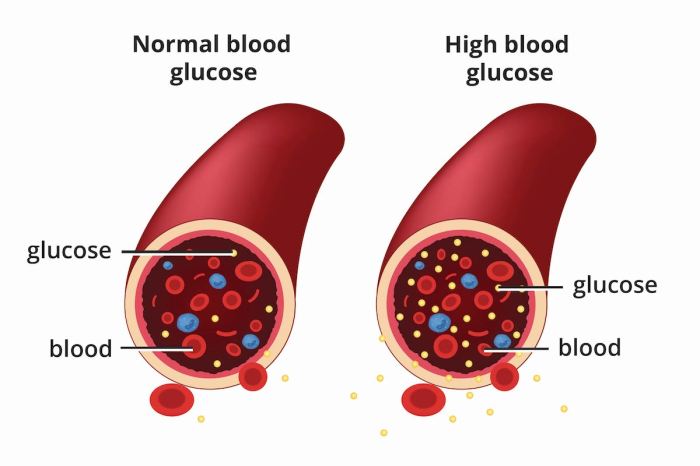

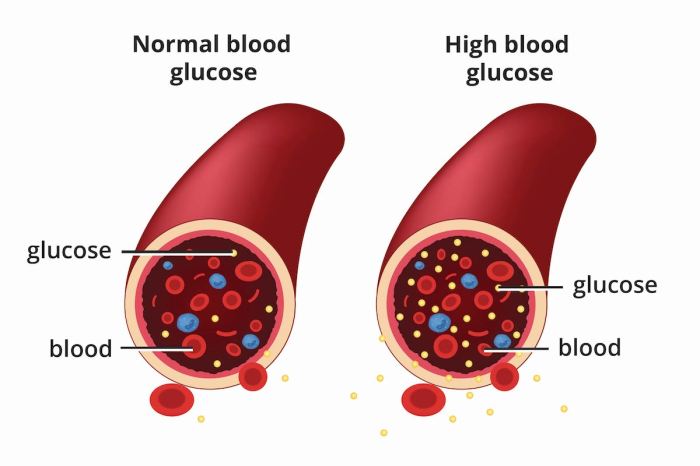

The figure illustrates the potential progression of both diabetes and colon cancer in a single patient. The x-axis represents time, and the y-axis represents the severity of each disease. The figure demonstrates how poorly controlled diabetes, represented by the upward trend in blood glucose levels, can correlate with the development and progression of precancerous polyps and ultimately, colon cancer. The figure highlights the importance of early detection and consistent management of both conditions to mitigate the risk and improve outcomes.

The figure illustrates the potential progression of both diabetes and colon cancer in a single patient. The x-axis represents time, and the y-axis represents the severity of each disease. The figure demonstrates how poorly controlled diabetes, represented by the upward trend in blood glucose levels, can correlate with the development and progression of precancerous polyps and ultimately, colon cancer. The figure highlights the importance of early detection and consistent management of both conditions to mitigate the risk and improve outcomes.