Hmo ppo epo pos whats the difference – HMO PPO EPO POS: what’s the difference? This guide dives deep into the world of health insurance plans, revealing the key distinctions between HMOs, PPOs, EPOs, and POS plans. Understanding these differences is crucial for making informed decisions about your healthcare coverage. We’ll explore coverage, network access, and cost considerations, so you can choose the plan that best suits your needs.

Each plan has unique characteristics, from the focus on preventative care in HMOs to the flexibility of PPOs. We’ll break down the specifics of each type, including the role of primary care physicians, out-of-network coverage, and the costs associated with using different providers. This comprehensive overview will help you navigate the complex landscape of health insurance plans.

Introduction to Health Insurance Plans

Navigating the world of health insurance can feel overwhelming. Different plans offer varying levels of coverage and access to care, making informed decisions crucial for your financial well-being and health. Understanding the key differences between HMOs, PPOs, EPOs, and POS plans is the first step towards choosing the right plan for your needs.Health insurance plans are designed to help individuals and families manage the costs associated with medical care.

These plans operate on a principle of shared risk, where individuals pay premiums in exchange for coverage of medical expenses. The type of plan you select significantly impacts your out-of-pocket costs and access to healthcare providers.

Types of Health Insurance Plans

Different health insurance plans structure their coverage and network access differently. These distinctions affect how much you pay for care, where you can receive care, and the overall cost of your health insurance. Understanding these variations is essential to make an informed decision.

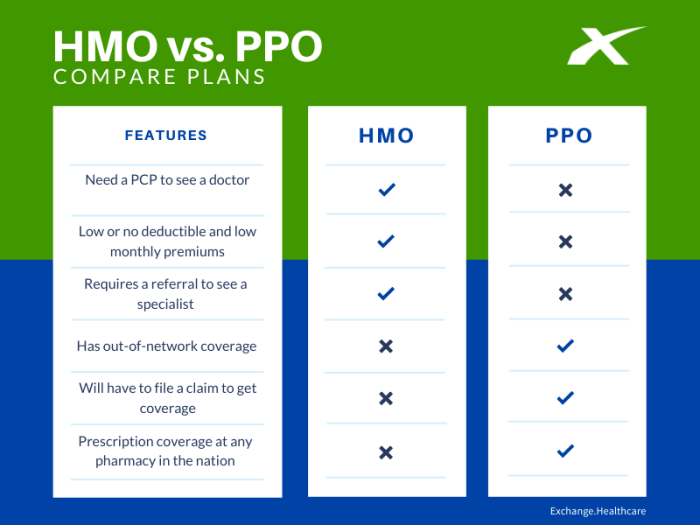

HMO (Health Maintenance Organization) Plans

HMO plans typically have a primary care physician (PCP) as a gatekeeper. This means you must see your PCP to get referrals for specialists. This structure helps control costs by limiting access to out-of-network providers. HMO plans often have a network of doctors and hospitals within a specific geographic area. This network can vary depending on the plan.

Cost-effectiveness is frequently achieved through lower premiums, with out-of-pocket costs often controlled by the need for referrals.

PPO (Preferred Provider Organization) Plans

PPO plans provide more flexibility than HMOs. You can see in-network or out-of-network providers without needing a referral. However, out-of-network care is typically more expensive. PPO plans usually have a broader network of providers compared to HMOs, allowing you to choose from a wider selection of doctors and hospitals. This flexibility comes at a cost; premiums are often higher than HMO plans.

EPO (Exclusive Provider Organization) Plans

EPO plans, like PPOs, allow access to in-network providers without referrals. However, EPO plans do not offer coverage for out-of-network care. The coverage is limited to the network of doctors and hospitals within the plan. EPO plans often balance flexibility with cost control, providing an alternative between HMOs and PPOs.

POS (Point of Service) Plans

POS plans blend elements of HMOs and PPOs. You have a PCP, but you can see in-network or out-of-network providers without referrals. However, out-of-network care typically carries higher costs. POS plans offer greater flexibility than HMOs, but still maintain some cost control mechanisms through the PCP structure. The cost often falls between HMO and PPO plans.

Comparison of Health Insurance Plans

| Feature | HMO | PPO | EPO | POS |

|---|---|---|---|---|

| Network Access | Limited to in-network providers; referral required for specialists | In-network and out-of-network options available; no referral required | In-network only; no referral required | In-network and out-of-network options available; PCP referral recommended but not required |

| Out-of-Network Coverage | Limited or no coverage | Limited coverage, typically higher costs | No coverage | Limited coverage, typically higher costs |

| Cost | Generally lower premiums | Generally higher premiums | Often between HMO and PPO in cost | Often between HMO and PPO in cost |

| Flexibility | Least flexible | More flexible | Moderately flexible | Moderately flexible |

HMO (Health Maintenance Organization) Plans

Health insurance plans come in various forms, each with its own set of characteristics and benefits. Understanding the nuances of these plans is crucial for making informed decisions about your healthcare coverage. One popular type is the HMO plan, which focuses on preventative care and a network of providers.HMOs are designed to promote proactive health management, aiming to reduce the overall cost of healthcare by emphasizing preventive measures.

This approach often leads to lower premiums compared to other plans, but comes with some restrictions. These restrictions are often necessary to achieve the goals of the plan.

Key Characteristics of HMO Plans

HMO plans typically require members to select a primary care physician (PCP) from a network of doctors. This PCP acts as a gatekeeper, coordinating care and referring members to specialists when necessary. This structure fosters a more coordinated and cost-effective approach to healthcare.

Role of Primary Care Physicians (PCPs) in HMOs

The PCP plays a vital role in HMO plans. They are responsible for initial consultations, preventative care, diagnosis, and treatment of minor illnesses. They also act as a liaison between the patient and specialists, ensuring appropriate referrals and care coordination. This crucial role ensures patients receive comprehensive and integrated care.

Restrictions on Out-of-Network Care

HMO plans typically place significant restrictions on out-of-network care. Generally, care from providers outside the HMO’s network is not covered or is only partially covered, or has higher cost-sharing. This restriction is a key feature of the plan and is designed to maintain cost control.

Examples of When an HMO Might Be a Suitable Choice

An HMO might be a suitable choice for individuals who prioritize preventative care and have a strong preference for a primary care physician as their primary point of contact. It’s also a good option for those who prefer a consistent care provider for routine health needs and who are comfortable with the limitations on out-of-network care.

Common Benefits and Limitations of HMO Plans

| Benefit | Limitation |

|---|---|

| Lower premiums compared to some other plans due to the focus on preventative care. | Limited network of providers, potentially requiring referrals for specialist care. |

| Strong emphasis on preventative care, leading to better health outcomes. | Restrictions on out-of-network care, potentially increasing costs if a specialist outside the network is needed. |

| Coordination of care through a primary care physician, reducing the potential for gaps in treatment. | Requires a commitment to choosing a PCP from a designated network. |

| Generally, lower cost-sharing for in-network care. | Potential for higher cost-sharing or denial of coverage for out-of-network care. |

PPO (Preferred Provider Organization) Plans

PPO plans offer a middle ground between the rigid structure of HMOs and the complete freedom of POS plans. They provide more flexibility in choosing doctors and hospitals, but with costs that can vary depending on whether you utilize in-network or out-of-network providers. Understanding these nuances is crucial for making informed decisions about your healthcare coverage.

Flexibility in Network Access

PPO plans typically have a wider network of providers compared to HMOs. This means you have more options when selecting doctors, specialists, and hospitals. You aren’t limited to a specific group of providers within a specific geographic area. This broader network gives you the freedom to choose the healthcare professional who best meets your needs, regardless of their location.

Cost Implications of In-Network vs. Out-of-Network Care

A key factor in PPO plans is the cost difference between using in-network and out-of-network providers. Using in-network providers generally results in lower out-of-pocket costs, as you pay a predetermined co-pay, co-insurance, or deductible. However, using an out-of-network provider often incurs higher costs, potentially leading to significant expenses. It’s essential to understand these cost structures before making a choice.

Cost Structures Comparison

The cost structure for in-network and out-of-network care in PPO plans often involves a tiered approach. In-network care typically involves lower co-pays, co-insurance, and deductibles. For example, a standard co-pay for a doctor visit might be $20 in-network, but $50 out-of-network. Out-of-network care often involves higher costs, which can be substantial, especially for complex procedures or extended stays.

In some cases, out-of-network providers may not be covered at all.

Benefits for Greater Provider Choice

PPO plans are advantageous for individuals who value the freedom to choose their healthcare providers. This flexibility is particularly helpful for those who might need a specialist not part of the HMO’s network or who prefer a specific doctor outside the plan’s immediate network. This wider selection of providers can be important for those with specific health conditions or preferences.

For example, a person with a rare disease might need a specialist not in the HMO’s network.

PPO Plan Comparison Table

| Feature | HMO | PPO | POS |

|---|---|---|---|

| Network Access | Limited, specific providers | Wider network, but some restrictions | Flexibility, with in-network and out-of-network options |

| Cost of In-Network Care | Usually lower, often fixed co-pays | Lower than out-of-network, but can vary | Lower if in-network, higher if out-of-network |

| Cost of Out-of-Network Care | Not covered or very limited | Higher than in-network, with a negotiated rate | Higher than in-network, with negotiated rates and potentially higher out-of-network costs |

| Flexibility | Limited | Moderate | High |

EPO (Exclusive Provider Organization) Plans

EPO plans, a middle ground between HMOs and PPOs, offer a structured network of healthcare providers while providing some flexibility. They strike a balance between the comprehensive coverage of PPOs and the stringent restrictions of HMOs. Understanding their nuances is crucial for making an informed decision about your healthcare coverage.

Figuring out HMO, PPO, EPO, and POS plans can be tricky, right? Understanding the differences between these healthcare options is crucial, especially when you’re managing a condition like hypothyroidism. For example, a healthy diet plays a major role in managing thyroid issues and weight loss, and if you’re looking for tips, check out this helpful resource on diet and weight loss tips for thyroid patients.

Ultimately, the best plan for you will depend on your individual needs and preferences, and doing your research is key to choosing the right one.

Network Structure

EPO plans have a defined network of healthcare providers. This network typically includes doctors, hospitals, and other medical facilities. Patients are encouraged to utilize providers within this network to maintain the most favorable cost structure and coverage. Choosing a provider outside the network will limit or eliminate coverage for services rendered. This structure offers a balance between the breadth of options found in PPOs and the targeted care emphasized in HMOs.

Out-of-Network Coverage Options

While EPO plans primarily focus on in-network providers, some out-of-network coverage may be available, but it’s typically limited and often at a significantly reduced rate. This means that care from a non-participating provider may be reimbursed at a lower percentage or not at all. Patients should carefully review their specific plan details to understand the extent of out-of-network coverage and associated cost-sharing.

Limitations and Advantages

EPO plans present a balance of advantages and limitations. A key limitation is the restricted network of providers, potentially impacting access to specialists or preferred facilities. However, the cost-effectiveness of staying within the network can be a significant advantage. The limited out-of-network coverage is a potential drawback, while the pre-negotiated rates with in-network providers offer a predictable cost structure.

The clear network structure makes it easier to manage healthcare expenses.

Examples of Suitable Scenarios

EPO plans are often suitable for individuals who prioritize cost-effectiveness and value a structured network of providers. For example, individuals who prefer a well-defined network and have a good understanding of their local healthcare facilities may find EPO plans beneficial. Additionally, individuals with a preference for staying within a specific region might find this approach suitable as it encourages use of local healthcare providers.

However, if frequent travel or need for specific specialists outside the network are common, an EPO plan may not be the ideal choice.

Comparison Table: EPO vs. HMO

| Feature | EPO | HMO |

|---|---|---|

| Network Structure | Defined network of providers; limited out-of-network coverage. | Tightly defined network of providers; virtually no out-of-network coverage. |

| Out-of-Network Coverage | Limited or reduced coverage for out-of-network services. | No coverage for out-of-network services. |

| Cost | Generally lower costs when using in-network providers. | Potentially lower costs with in-network providers, but limited flexibility. |

| Flexibility | More flexibility than HMO plans, but less than PPO plans. | Least flexible option. |

POS (Point of Service) Plans

POS plans offer a blend of HMO and PPO features, providing a middle ground for healthcare coverage. This hybrid approach allows flexibility in choosing providers while maintaining some cost control. Understanding the nuances of POS plans is crucial for making informed decisions about your healthcare coverage.

Hybrid Nature of POS Plans

POS plans combine elements of HMO and PPO plans, offering a middle ground in terms of flexibility and cost. Members have the option to use in-network providers, which generally result in lower out-of-pocket costs, or choose out-of-network providers, which will often incur higher costs. This hybrid nature allows for greater flexibility compared to HMO plans, but with more structure than PPO plans.

Care Options Within a POS Plan

POS plans provide a range of care options, allowing members to select in-network or out-of-network providers. Using in-network providers generally leads to lower costs, as they are contracted with the insurance company at predetermined rates. However, out-of-network providers can be utilized, but these services will typically be subject to higher cost-sharing and may not be covered fully.

Costs Associated with In-Network and Out-of-Network Providers, Hmo ppo epo pos whats the difference

The cost of care varies significantly depending on whether a provider is in-network or out-of-network. Using in-network providers generally means lower co-pays, co-insurance, and deductibles. Out-of-network care, on the other hand, usually involves higher cost-sharing amounts, often including a higher percentage for the cost of services. For example, a routine office visit with an in-network doctor might cost a $20 co-pay, while the same visit with an out-of-network doctor could cost $100 or more.

Understanding these differences is critical to managing your healthcare expenses.

Flexibility of POS Plans

POS plans offer more flexibility than HMO plans, but less than PPO plans. Members can choose to utilize out-of-network providers, although this often results in higher costs. This contrasts with HMO plans, where the selection of providers is more limited. The greater flexibility compared to HMO plans allows members to seek care from specialists or doctors outside the network, if necessary.

Comparison of POS, HMO, and PPO Plans

| Feature | HMO | PPO | POS |

|---|---|---|---|

| Network | Limited to in-network providers | Wider network of in-network providers | Allows both in-network and out-of-network providers |

| Cost-sharing (in-network) | Generally lower | Generally lower | Generally lower |

| Cost-sharing (out-of-network) | Limited or not available | Higher, but often with cost-sharing | Higher, with cost-sharing |

| Flexibility | Low | High | Moderate |

| Premium Costs | Often lower | Often higher | Often in the middle range |

This table highlights the key differences in network access, cost-sharing, and flexibility among the three plans. It provides a concise overview to help compare and contrast the various options available.

Choosing the Right Plan

Choosing the right health insurance plan is a crucial decision that significantly impacts your financial well-being and access to healthcare. Understanding the different types of plans and your individual needs are paramount to making an informed choice. This process requires careful consideration of factors like your health status, lifestyle, and anticipated medical expenses.

Factors to Consider When Selecting a Plan

Selecting the appropriate health insurance plan demands careful consideration of various factors. Your personal health history, anticipated medical needs, and financial situation are key determinants. Understanding the nuances of each plan type is equally important, enabling you to choose a plan that best suits your requirements.

- Health Status: Pre-existing conditions, chronic illnesses, and family history of medical issues play a vital role. Individuals with pre-existing conditions should prioritize plans that provide coverage without limitations or high deductibles. This ensures that necessary medical care is accessible and affordable.

- Lifestyle and Activities: A physically active individual with a higher likelihood of sports-related injuries might benefit from a plan with greater coverage for such occurrences. Likewise, a person with a sedentary lifestyle might opt for a plan with a lower premium. Your lifestyle choices and activities can significantly impact the plan that best aligns with your needs.

- Financial Situation: The cost of premiums, deductibles, and co-pays is crucial. A plan with a lower premium but higher deductibles might be more economical for someone with a consistent income, while a person with fluctuating income might favor a plan with a higher premium and lower deductibles. Your financial capacity and anticipated medical expenses should be considered.

- Expected Medical Needs: Anticipated medical needs, such as regular check-ups, prescriptions, or potential surgeries, should influence your plan selection. Individuals anticipating significant medical expenses might choose a plan with comprehensive coverage and lower deductibles.

Examples of Plan Appropriateness

Understanding when each plan type is most suitable is essential for informed decision-making. The specific circumstances of each individual should determine the plan’s suitability.

- HMO (Health Maintenance Organization): Ideal for individuals with predictable healthcare needs and a preference for in-network providers. This is a good option for individuals who anticipate minimal or consistent healthcare needs and value cost-effectiveness. A young, healthy individual who primarily visits a primary care physician for preventative care would likely find an HMO to be an excellent choice.

- PPO (Preferred Provider Organization): Suitable for individuals seeking greater flexibility in choosing healthcare providers, even those outside the network. This is a suitable choice for individuals who anticipate needing care from specialists or those who frequently travel. An individual with a family history of chronic illnesses or potential need for specialized care might benefit from a PPO plan.

- EPO (Exclusive Provider Organization): A good fit for individuals who prefer in-network care but have some flexibility in choosing providers. An individual who has a primary care physician but also needs to see specialists on occasion would benefit from an EPO plan. This plan is more suitable for individuals who want in-network coverage but prefer some flexibility in choosing their providers.

- POS (Point of Service): A plan that blends HMO and PPO features, offering flexibility in choosing providers. This plan is ideal for those who value flexibility and may need to visit out-of-network providers occasionally. Individuals with unpredictable healthcare needs or those who anticipate visiting out-of-network specialists might find a POS plan to be more suitable.

Understanding Coverage Details

Thorough review of the coverage details before enrollment is critical. This includes a detailed analysis of premiums, deductibles, co-pays, co-insurance, and out-of-pocket maximums.

- Premiums: Monthly payments for health insurance coverage. The premium amount will vary depending on the plan and your personal circumstances. Individuals should carefully compare premium costs across different plans.

- Deductibles: The amount you pay out-of-pocket for covered services before your insurance starts paying. Higher deductibles often translate to lower premiums. This is a critical factor for individuals with predictable healthcare needs.

- Co-pays: Fixed amounts you pay for certain medical services. Understanding the co-pay structure is essential to managing potential healthcare expenses.

- Co-insurance: A percentage of the cost of a medical service that you pay after meeting your deductible. Co-insurance percentages vary across plans and medical services.

- Out-of-Pocket Maximum: The maximum amount you will pay out-of-pocket for covered services in a given plan year. This is a crucial factor for individuals with unpredictable healthcare needs.

Steps to Consider When Selecting a Health Insurance Plan

A structured approach to selecting a health insurance plan ensures a well-informed decision. This flowchart illustrates the steps involved in the process.

Cost Comparison and Considerations

Understanding the financial aspects of health insurance is crucial for making informed decisions. Different plans have varying costs, and understanding the components of those costs is vital. This section delves into the factors that influence plan prices, the role of deductibles, co-pays, and co-insurance, potential out-of-network expenses, and how to effectively compare total costs across various options.

Factors Influencing Health Insurance Plan Costs

Several factors contribute to the price of health insurance plans. Premiums, the monthly payments you make, are influenced by factors like your age, location, health status, and the type of coverage offered. More comprehensive plans, covering a wider range of services, typically have higher premiums. Additionally, the claims experience of the insurance company, reflecting the overall costs of medical care in the area and the specific population covered, directly affects premium pricing.

Lastly, the regulatory environment, including government subsidies and mandates, also plays a role in shaping the market rates for plans.

Role of Deductibles, Co-pays, and Co-insurance

These three components represent the financial responsibility you assume when accessing healthcare services. A deductible is the amount you pay out-of-pocket before your insurance starts to contribute. Co-pays are fixed amounts you pay for specific services, like doctor visits or prescriptions. Co-insurance is a percentage of the cost of a service you pay after meeting your deductible.

Understanding these elements is essential for budgeting healthcare expenses. For example, a plan with a high deductible might offer lower monthly premiums, but you’ll have a larger financial responsibility initially before insurance kicks in. Conversely, a plan with a lower deductible might have higher monthly premiums.

Potential Costs Associated with Out-of-Network Care

Out-of-network care, meaning seeking services from a provider not in your insurance plan’s network, often comes with higher costs. HMOs typically limit coverage for out-of-network care, while PPOs offer some coverage, often at a reduced rate. EPOs have more limited out-of-network coverage, with a possible option for reimbursement at a reduced rate. POS plans offer a blend of in-network and out-of-network options.

The amount you’ll pay out-of-pocket for out-of-network care can significantly vary depending on the plan and the provider. Consider a scenario where a patient needs specialist care outside their plan’s network. They might face substantial costs, especially if the plan’s out-of-network coverage is minimal.

Figuring out HMO, PPO, EPO, and POS plans can be a real headache, right? Understanding the differences between these types of health insurance is key to choosing the right one for your needs. Luckily, knowing about aca compliant health insurance can often make this process much easier, as it dictates what coverage is required. Ultimately, the best plan will depend on your individual health needs and budget, and the differences between HMO, PPO, EPO, and POS plans remain important factors to consider.

Comparing Total Cost of Care Across Different Plans

To compare the total cost of care across different plans, you need to consider not only premiums but also deductibles, co-pays, co-insurance, and out-of-network costs. Don’t just look at the monthly premium; analyze the total cost of care scenarios to determine which plan is the most cost-effective for your needs. For instance, a plan with a lower premium might have a high deductible, leading to higher out-of-pocket costs if you require significant healthcare services.

Figuring out HMOs, PPOs, EPOs, and POS plans can be tricky, right? Understanding the differences between these healthcare options is crucial, especially when managing a condition like left sided heart failure. Left sided heart failure can impact your choice of plan, requiring careful consideration of the coverage specifics. Ultimately, the best plan depends on your individual needs and the level of care you’ll require.

Knowing the specifics of each plan is key to making the right choice.

Cost Structure Comparison Table

| Plan Type | Deductible | Co-pay (Example: Doctor Visit) | Co-insurance (Example: Hospital Stay) | Out-of-Network Cost (Example: Specialist) |

|---|---|---|---|---|

| HMO | $2,000 | $25 | 80/20 | Limited or None |

| PPO | $1,500 | $35 | 80/20 | Reduced Rate |

| EPO | $1,000 | $40 | 80/20 | Reduced Rate |

| POS | $1,200 | $30 | 80/20 | Reduced Rate |

Note: The table provides examples. Specific costs can vary widely based on plan specifics and individual circumstances.

Network Access and Provider Choices

Understanding your health insurance plan’s provider network is crucial for navigating healthcare efficiently and effectively. The network dictates which doctors, hospitals, and specialists you can see without incurring extra costs or needing pre-authorization. This knowledge empowers you to make informed decisions about your care and ensures you have access to the providers best suited to your needs.Choosing a plan with a wide and comprehensive network is often a significant factor in the cost and convenience of healthcare.

For instance, if your preferred specialist isn’t in your plan’s network, you may face higher out-of-pocket costs or have to seek a less suitable alternative. This underscores the importance of thoroughly researching and understanding the provider networks associated with different plans.

Importance of Provider Network Understanding

Understanding your plan’s provider network is essential to avoid unexpected expenses and ensure you have access to the care you need. A limited network might force you to choose a provider who isn’t your first choice or isn’t as specialized in your health concern, potentially impacting the quality and efficiency of your treatment. This understanding allows for more proactive planning and helps in managing potential costs.

Examples of Network Access Impact

Network access directly affects your healthcare choices. If a doctor you trust and have a positive relationship with isn’t in the plan’s network, you might be compelled to seek care elsewhere, potentially impacting the quality of care. Similarly, accessing specialized care like cardiology or oncology services might be more challenging or costly if the necessary providers aren’t within the network.

These examples highlight how a plan’s network directly affects the accessibility and cost of care.

Finding Providers Within a Specific Network

Your health insurance plan’s website often provides a searchable directory of in-network providers. This directory typically allows you to search by location, specialty, or name. You can also use online tools or contact your insurance company’s customer service to find providers who are part of your plan’s network. These resources help you locate suitable providers who meet your specific needs.

Limitations of Choosing Providers Outside the Network

Choosing providers outside your health insurance plan’s network can lead to higher out-of-pocket costs. You might be responsible for a larger share of the cost, potentially including deductibles, co-pays, and co-insurance. This can significantly increase the overall expense of your care. Furthermore, some services might require pre-authorization from the insurance company, adding an extra layer of complexity to the process.

Understanding these limitations is key to making informed decisions about your care.

Comparison of Provider Networks

| Plan Type | Network Size (General Description) | Network Scope (General Description) |

|---|---|---|

| HMO | Generally smaller, focused on primary care physicians within a specific geographic area. | Concentrated, typically offering a wider range of primary care options but potentially limited specialty care. |

| PPO | Generally larger, encompassing a broader geographic area and more providers, including specialists. | Widespread, offering more choices of specialists and hospitals but with higher out-of-network costs. |

| EPO | Mid-sized, typically encompassing a broader range of providers than HMOs but narrower than PPOs. | More choices than HMOs, but still more limited than PPOs, often offering greater flexibility for specialists but with out-of-network costs if going outside the EPO network. |

| POS | Variable, encompassing a broader range of providers than HMOs but potentially smaller than PPOs, often having both in-network and out-of-network options. | Balanced, offering both in-network and out-of-network options, but the cost of out-of-network care may vary depending on the plan. |

Note: The size and scope of provider networks can vary depending on the specific insurance company and the plan you choose. Always check with your insurance provider for details about their specific network.

Last Recap: Hmo Ppo Epo Pos Whats The Difference

In conclusion, understanding the nuances of HMO, PPO, EPO, and POS plans is essential for securing optimal healthcare coverage. This exploration has highlighted the critical factors to consider when choosing a plan, emphasizing the importance of evaluating your individual needs and circumstances. Remember to carefully compare coverage details, network access, and cost structures before making a commitment. By doing your research and understanding the nuances of each plan, you can make an informed decision that aligns with your healthcare priorities and financial situation.